-

Build your credit

Up to a $10,000 credit limit. Higher limits allow you to spend more and build your credit history. 1

-

No SSN required

Apply without a Social Security Number (SSN) or previous credit history. 1

-

Global acceptance

Accepted globally without foreign transaction fees. 3

Comparison of features

| Bank of America | Citibank | |

| Apply with no SSN | | | |

| Maximum Credit Limit | $10,000 | $5,000 | $2,500 |

| Annual Percentage Rate (APR) | 20.99% | 26.24% | 27.74% |

| Foreign Transaction Fee | No fee | 3% | 3% |

| Apply with no SSN | |

|---|---|

| |

| Bank of America | |

| Citibank | |

| Maximum Credit Limit | |

|---|---|

| $10,000 |

| Bank of America | $5,000 |

| Citibank | $2,500 |

| Annual Percentage Rate (APR) | |

|---|---|

| 20.99% |

| Bank of America | 26.24% |

| Citibank | 27.74% |

| Foreign Transaction Fee | |

|---|---|

| No fee |

| Bank of America | 3% |

| Citibank | 3% |

East West Bank information accurate as of 02/01/2024. Information from other listed institutions is from the institutions’ websites and is accurate as of 12/04/2023. The data listed above may change, and additional features and terms may also apply to each institution’s secured card product.

Secured Credit Card Benefits

Secured Credit Card Benefits

- No SSN required

Build your U.S. credit history even without a Social Security Number (SSN). - Up to a $10,000 credit limit

Higher limits allow you to spend more and build your U.S. credit history. - Establish your personal credit history 1

We report information about the status and payment history of your Secured Credit Card to Experian, one of the three major credit bureaus in the United States. Apply today to start building your credit history! - No foreign transaction fees, no annual fees 3

Enjoy the convenience and value of our Secured Credit Card at home or abroad. - Tap and go

Add your Secured Credit Card to a digital wallet to make purchases in store, online or in app.

Get Started with the Secured Credit Card

Activate Card

-

Activate your card

Once you receive your Secured Credit Card, activate it by following the instructions included with your card.

-

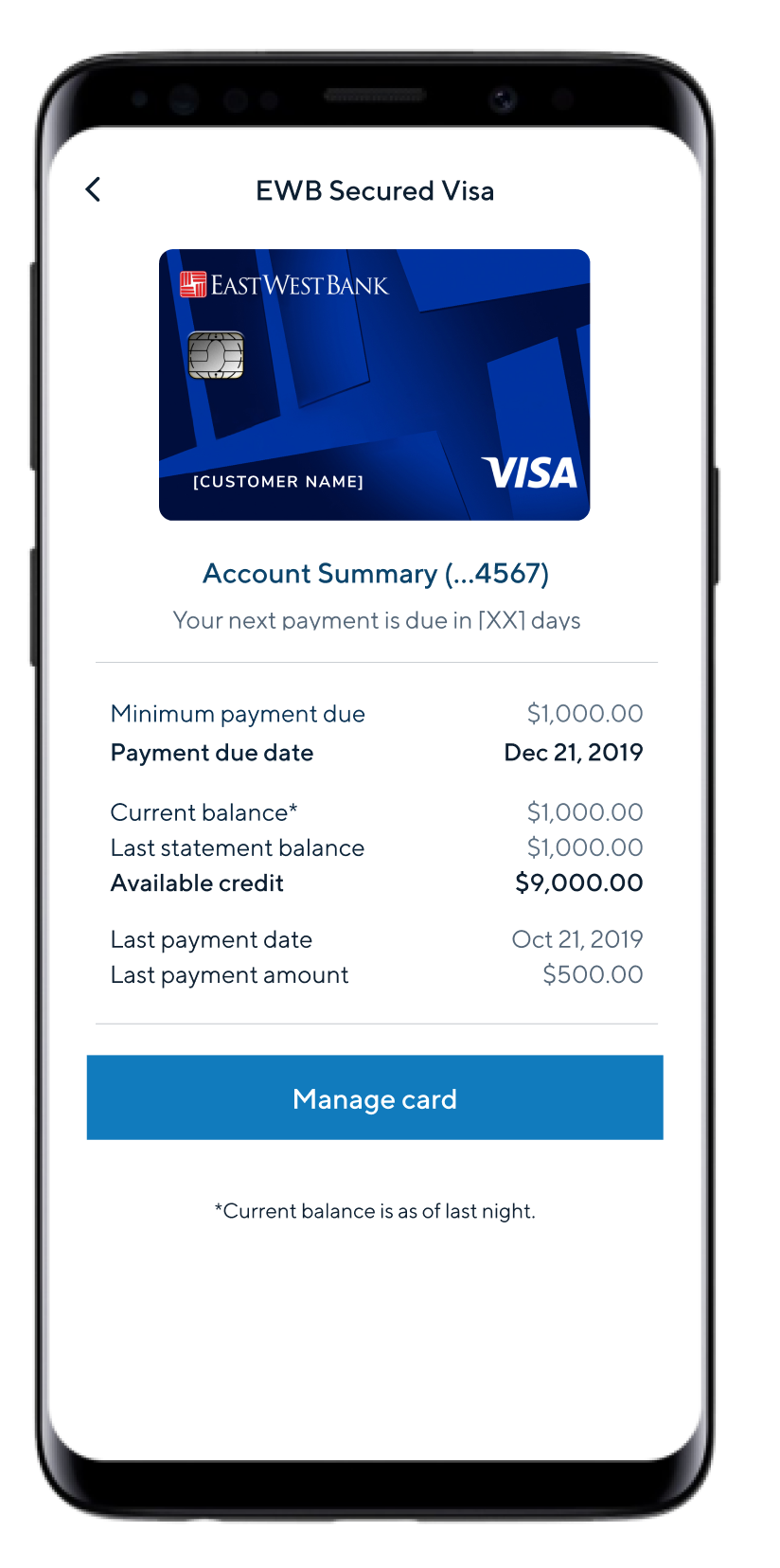

Manage your card

After you activate your card, use the Manage card feature in our Mobile App or Online Banking service to access a full suite of card management tools:

Set up a payment account to make recurring or one time payments to your card.

Review your balance, available credit, and transactions.

Download your secure credit card statements.

Set up alerts to notify you when important events occur on your Secured Credit Card. -

Enjoy your card

Enjoy using your Secured Credit Card and start building your credit history in the U.S.1